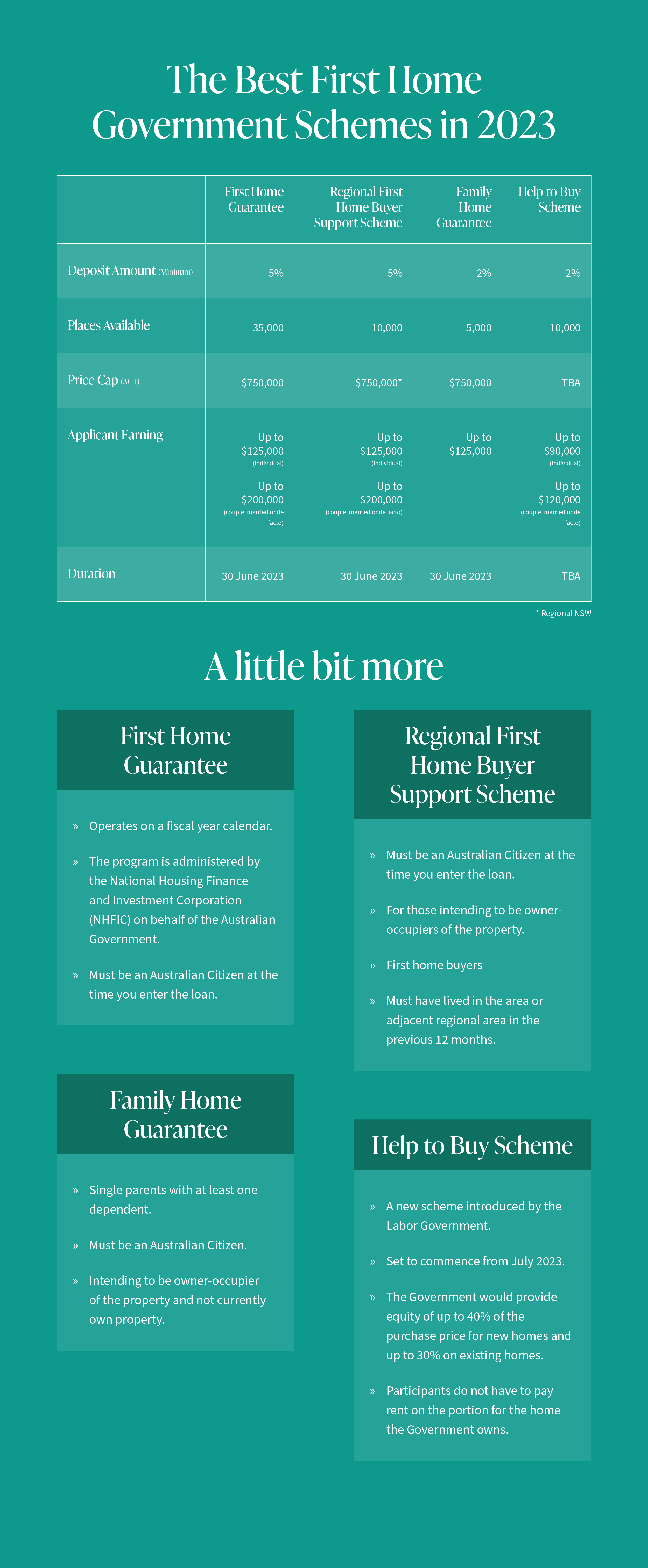

Numerous surveys find that there is a lack of awareness among first-home buyers about these programs. So, here we list the major announced grants and schemes for first-home buyers, as of 2023.

The housing market has experienced unprecedented highs in recent years. As the economy adjusts post-pandemic, it is anticipated that the housing market will level out in that prices on the upper end of the scale will decrease in price and apartments on the lower end will remain steady. Working tourism is expected to surge this year, placing even more demand on rental properties, which is why lower-end properties are expected to maintain price.

The demand and impending prices have presented great barriers to entry for first-home buyers. A number of incentive programs by the Government are available to assist with this however, it can be tricky to decide which program is most suitable for your individual circumstances.

We have compiled information on four help-to-buy programs available to first-home buyers in 2023 to help you understand what is on offer.

First Home Guarantee

The First Home Guarantee scheme operates on a fiscal year calendar; 35,000 places became available on July last year and will be available for application through till 30 June 2023. The program is administered by the National Housing Finance and Investment Corporation (NHFIC) on behalf of the Australian Government; the NHFIC guarantees part of an eligible first home buyers’ loan with participating lenders.

Eligibility criteria key points include you will be an Australian Citizen at the time you enter the loan, at least 18 years of age, as an individual you earn $125,000 or $200,000 as a couple (married or de facto), intending to be owner-occupiers of the property, 5% minimum deposit required and be a first home buyer. You can check eligibility here.

Regional First Home Buyer Support Scheme

10,000 Regional First Home Buyer Guarantee (RFHBG) places became available on 1 October 2022 and will close on 30 June 2023. Under the scheme, eligible home buyers can purchase a home with as little as a 5% deposit.

Eligibility criteria key point include, you will be an Australian Citizen at the time you enter the loan, at least 18 years of age, as an individual you earn $125,000 or $200,000 as a couple (married or de facto), you are intending to be owner-occupiers of the property, you can offer a 5% minimum deposit required, you are first home buyers and you have lived in the regional area or adjacent regional area they are intending to purchase in for the preceding 12-month period. You can check eligibility here.

Family Home Guarantee

The Family Home Guarantee scheme operates on a fiscal year calendar, only 5,000 places became available in July last year and will be available for application through to 30 June 2023.2023. This initiative was implemented to support eligible single parents with at least one dependent.

Eligibility criteria key points include individual application, you are a single parent with at least one dependent child, you are an Australian Citizen at the time you enter the loan, you are at least 18 years of age, you are earning no more than $125,000, you are intending to be owner-occupier of the property and you do not currently own property. The NHFIC guarantees part of an eligible home buyer’s home loan from a participating lender, which enables the applicant to purchase a home with as little as a 2% deposit. You can check eligibility here.

The scheme defines single-parent, previous home ownership and dependent, which you can read here.

Help to Buy Scheme

Help to Buy is a new scheme introduced by the Labor Government that is set to commence from July 2023. There will be 10,000 places available for eligible Australians. The proposal for the scheme identifies itself as a national shared-equity scheme that aims to assist people on low-to-moderate incomes to purchase a home. Via the NHFIC, the Government would provide equity of up to 40% of the purchase price for new homes and up to 30% on existing homes. Participants do not have to pay rent on the portion of the home the Government owns.

Participants must have at least a 2% deposit and will need to repay the loan when they sell the property or over-time will pay increments of at least 5% to increase their stake.

Eligibility criteria key points include you will be an Australian Citizen at the time you enter the loan, you are at least 18 years of age, you earn no more than $90,000 or no more than $120,000 as a couple (married or de facto), you are a first home buyer with the intention to be owner-occupier of property, you own no overseas property and you are able to pay a deposit of at least 2%.

It is important to note that if your income exceeds the maximum amount allowed for two consecutive years, you will have to repay the Government’s financial contribution in part or whole as circumstances permit.

Further information regarding eligibility and price caps is yet to be officially released.

Printable version here: The Best First Home Government Schemes in 2023

Find Out Which Schemes Are Available To You

We can help you navigate the schemes available and determine which option is best for you. There are other schemes available that could be more appropriate depending on your individual circumstances.

At Green Associates, all of our advisers are fully licensed and listed on the ASIC Moneysmart Financial Adviser Register. Green Associates is committed to providing the best solutions for you and your wealth-creation journey.

Speak to one of our team on 1300 815 921 or at info@greenassociates.com.au.