Not even a banking crisis or recession fears have been able to stop the US market’s gravity-defying run this year – with the S&P 500 being a mere single digit percentage increase away from its all-time high. This can once again be attributed to the hypertrophy of the tech sector.

The overall picture

Lately, all eyes have been on the US’s tech sector and how the S&P 500 is being impacted by the tech sector’s largest players. In this blog, we explore what is driving these “super stocks”, how they are driving the market and how the US$1 trillion club should influence your investment strategy.

The biggest 5 names in this tech industry are all part of an elite club of companies with a market cap of over US$1 trillion — Apple, Microsoft, Alphabet, Amazon and the market’s latest darling – Nvidia.

Who’s Nvidia?

Nvidia is a chipmaking company that products power generative AI, which is AI like ChatGPT, that can create new content in response to use prompts. The company experienced a one-day gain of US$184 billion at the end of May. To put this into perspective, this is larger than the market cap of huge long-standing companies like Disney and Nike.

What has sent Nvidia’s prices soaring is its role in generative AI and the market’s seemingly unbridled enthusiasm over the technology.

The frenzy is also driving up the prices of the other members like Apple, Microsoft and Alphabet and is not exclusive to the US either, with the French start-up Mistral AI recently raising AUD$167 million in Europe’s largest-ever seed round — without even having a product yet.

The current situation

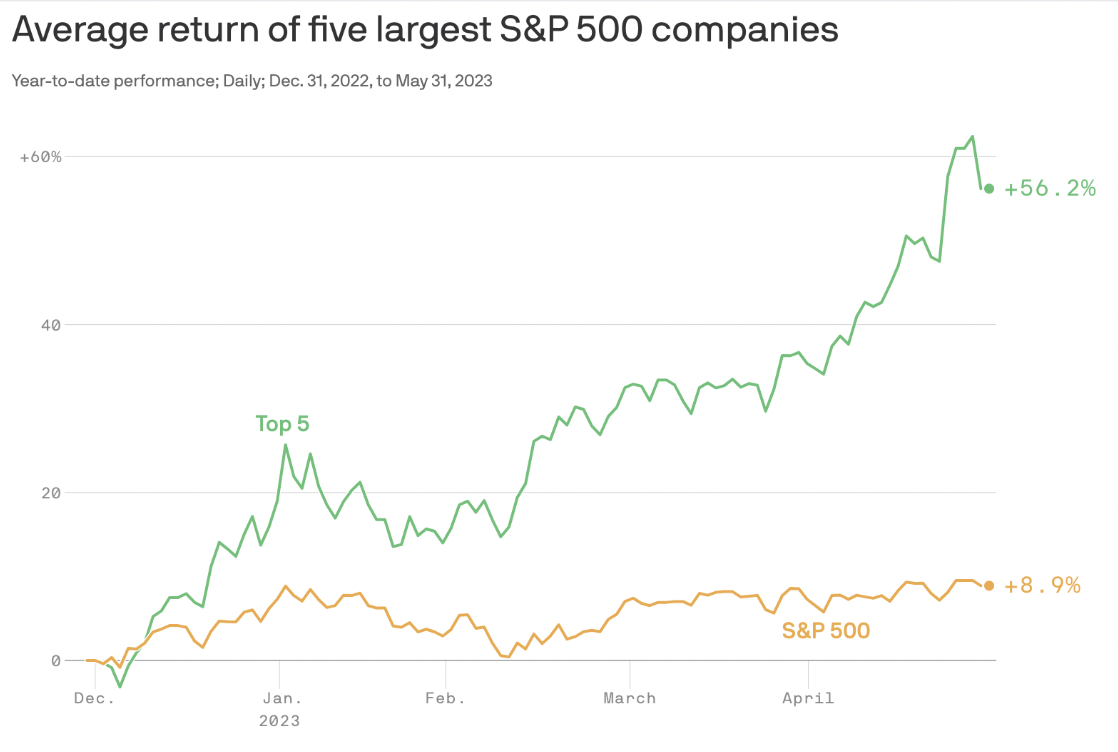

If we look at the market performance in this date range (31 Dec 2022 – 31 May 2023) – the S&P 500 is up 8.9%, due to the surging prices of the top 5 companies.

Broad market indexes (like the S&P 500) and broad market ETFs are increasingly composed of these super stocks. In fact, the super stocks make up 28% of the S&P 500. It is important to note that the index is a market cap-weighted index, meaning that the companies with the largest market caps have the largest impact on how the overall index moves.

The super stocks have had an astronomical run so far with the US$1 trillion club’s price-to-earning (P/E) ratio currently at 43, up from 28.3 at the end of 2022. This ratio is calculated by dividing the market price per share by earnings per share and is commonly used as a measure of the market’s expectations for future earnings growth and profitability.

Following suit, the S&P 500 has gained just below 9% this year as at May.

Yet, if adjusted for the super stocks, it’s been calculated according to data provided by Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, that the overall market would only be up 1.5%.

Furthermore, if you then adjusted for the 2 other largest tech companies, Meta and Tesla, the S&P 500 would actually be “slightly underwater”.

Many currently believe that the super stocks are overpriced and even a recalibration of the P/E ratio to its level at the end of 2022 would wipe almost two-thirds of the S&P 500’s gain.

So, should you be investing in super stocks?

Of course, it’s not the first time the market is led by a significant few.

Most recently, the market was dominated by FAANG – Facebook (currently known as Meta), Amazon, Apple, Netflix and Google (currently known as Alphabet).

In the 1990s, the prominent companies were Intel, Oracle, Microsoft and Cisco; the group referred to as the Four Horsemen.

So, the wisest action to take is not to view the movements or coupling of the US tech sector and overall market as a “STOP” sign, but more like a “SLOW DOWN” sign.

Before we get caught up in the AI frenzy and perceive it as overall market success, it’s vital to assess our investment strategy with the recognition that while the tech stocks are rallying, the rest of the market is underperforming.

How to invest in an AI stock like Nvidia

To ride the AI wave, you could invest in a stock like Nvidia individually but considering its supercharged prices, this would call for a substantial outlay as well as a strong risk appetite — and a commitment to hold on when times get tough.

The latter is crucial because even if the current trends don’t equate to a bubble like the dot-com bubble, there will still be the volatility associated with an industry that’s very early in its lifecycle; this can lead to significant downfalls and losses.

When looking at other stocks like Microsoft and Alphabet that are still tied to the AI hype, the risk is considerably lower, as they are more established companies with a longer track record of growth and profitability. Of course, the outlay is still considerably large.

One way to mitigate both price and risk is to invest in these super stocks through a broad market index or an AI-specific ETF. With a broad market index, you’d benefit from the diversification, while if you were to invest in an AI-specific ETF, you would be gaining exposure not only to AI-related hardware companies like Nvidia, but also software companies serving the industry and the AI specialists themselves.

When we compare both, theoretically, you’d be more exposed to the AI industry’s volatility with an AI-specific ETF than if you were to invest in a broad market index.

How Green Associates can help refine your investment strategy

One of our experienced Green Associates Financial Advisers can support you in creating and managing a portfolio that aligns with your financial circumstances and goals.

If you are specifically interested in AI, part of this could include:

- Learning more about the AI sector and how it might impact the economy;

- Understanding which players in the AI industry are likely here to stay with a robust suite of products and services and which may fizzle out with the hype;

- Identifying other high-growth stocks, which also involves understanding the sector and industry (including barriers to entry and new developments) and how its customers and users behave.

If you need help with your investment strategy, book an appointment today.

At Green Associates, all of our advisers are fully licensed and listed on the ASIC Moneysmart Financial Adviser Register. Green Associates is committed to providing the best solutions for you and your wealth-creation journey.