Make larger concessional contributions if you haven’t used all your concessional cap in an earlier year.

It’s been financially tough recently. If you have had interrupted income and have not been able to contribute to Super as much as you’d like, catch-up concessional contributions may provide a window to top up at a more convenient time.

Since 2021, the annual super concessional contribution cap has been $27,500 per year. This means you can make a total yearly contribution of that amount to your super fund and have it taxed at only 15%, much lower than your marginal tax rate! But what happens if you haven’t taken advantage of your entire contribution cap?

Fear not, there’s hope yet. Carry forward rules have been introduced to allow you to access unused concessional cap amounts from previous years – for up to 5 years earlier.

In this article, we outline the what’s, why’s and how’s of concessional catch-up contributions so that you don’t miss out on the chance to save on taxes, build your retirement fund, and use the full contribution cap to maximise all benefits.

What are concessional contributions:

In addition to the super guarantee of 10.5% paid by employers, concessional contributions (which count toward your concessional contributions cap) also include salary sacrifice arrangements and extra personal deductible contributions.

Voluntary salary sacrifice, also known as salary packaging or total remuneration packaging, is an arrangement between your employer and you, where a portion of your pre-tax salary is redirected to your super fund. By doing this, your taxable income is reduced. For your employer, their super guarantee (SG) obligation is reduced. Learn more about salary sacrifice on the ATO website.

You can also make voluntary tax-deductible contributions when you transfer funds from your bank account into your super, which you can then claim a tax deduction for.

Generally, concessional contributions get special tax treatment, meaning that you’ll generally pay less tax on your super contributions compared to any income you receive.

How do the carry forward rules work?

From 2019-20, your unused cap amounts accrue and can be carried forward for up to 5 years before they expire.

This means that if you only made a total of $20,000 in concessional contributions in 2020-21, you can use the $7,500 that was not utilised of the $27,500 cap in another financial year. The amounts can be “carried” forward up to 5 years, and are taxed at only 15%.

These carry forward rules were created for greater flexibility with super — for example, for those with broken work patterns, perhaps due to maternity leave, for those who can’t afford to contribute in a particular year and want to make up for it.

Why would you want to make larger concessional contributions?

Despite its complexities, super is still an effective retirement savings tool in Australia and yet many reports find that a lot of us are not on track to have enough super to fund our retirement. Concessional contributions can be used to supercharge your future savings and minimise current tax liabilities.

Firstly, thanks to the power of compounding, any contribution you make to your super will pay you back in spades at retirement. A super balance of 5-figures (like $85,000) in your 30s can grow to 7-figures (like $1.5 million) by the time you retire at 65, purely from the super guarantee.

Secondly, because concessional contributions are tax deductible and they are taxed at significantly lower than your marginal tax rate, you are reducing your taxable income and saving on tax. This can be especially useful in high-income years such as when you have a capital gains tax event such as selling an investment property or receive a significant bonus.

How do I know how much my available concessional contributions cap is?

Unused cap amounts have been carried forward since 2018-19 and are available for a maximum of 5 years after to be used to “catch-up”. This means your 2018-19 unused cap will expire by 2023-24. You will always use the oldest unused caps first.

To find out exactly how much is available to you, log in to ATO online services, select Super, then select Concessional contributions.

What are the eligibility criteria I need to meet?

You can play catch-ups with the cap if you meet all of the below conditions:

You:

- Have unused concessional contributions cap amounts from up to 5 previous years (but not before 1 July 2018).

- Have a total super balance of less than $500,000 on 30 June of the previous financial year. Your total super balance is broadly the sum of all your super accounts including pensions.

- Make concessional contributions in the financial year that exceed your general concessional contributions cap.

Regarding timing, it is important to consider when concessional contributions are received by your super fund, not just when the payment is sent.

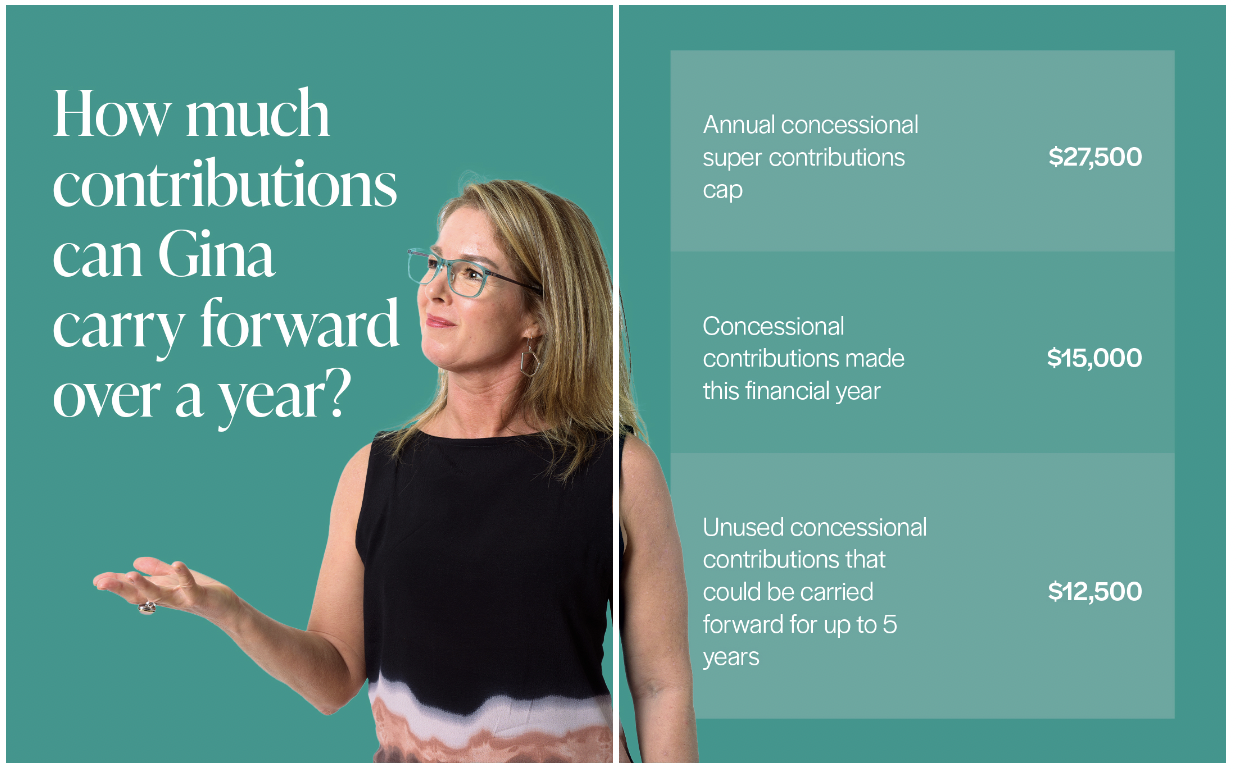

The above scenario means that, at any time over the next 5 years, Gina is entitled to freely contribute up to the annual concessional contributions cap of $27,500, plus the unused cap amount of $12,500. This means that Gina could contribute up to $40,000 in concessional contributions in one financial year, if her total super balance is less than $500,000 on 30 June of the previous financial year.

If in this scenario, Gina also carried forward unused cap amounts from the four years following, she would also be able to contribute any additional unused amounts on top of that, noting her total super balance would need to still be under $500,000 on 30 June of the previous financial year to do so.

Note: This example is for illustration purposes only. It isn’t an estimate of the investment returns you might receive, or fees and costs you might incur.

How do I make sure my concessional contributions are accounted for?

When you are making personal contributions and you are eligible to claim a tax deduction, here are the steps you must complete:

- Make the contribution after checking how much you can contribute

- You must complete a S290 (notice of intent to claim) form provided by your fund. This must be done by the earliest of the following:

- Lodging your tax return

- End of the following financial year in which you made the contribution

- Making a withdrawal, this includes rollovers and insurance premiums funded by rollovers

- Commencing a pension

- Your fund must send you a written acknowledgment in receipt of your valid form.

- You must receive this acknowledgment from your fund before you claim the deduction on your tax return.

- If you want to claim an amount that is different (more or less) than what the notice says, you can vary your notice of intent within the timeframes outlined.

It can be helpful to engage an accountant or your financial adviser to help you navigate this process.

So, how can a Green Associates financial adviser help my super and me?

At Green Associates, our superannuation advice and planning service can help you gain a clear understanding of where your super is at and how both concessional contributions and non-concessional contributions can be used to boost the balance and minimise tax. Together, we can work out what your unused cap amounts are and the best way to catch up on them.

We’ll also sit down with you to chat about additional tax and penalties in case you exceed the concessional and non-concessional super contribution caps. We’ll also chat to you about the fluctuating value of your investments in super, so you’re a hundred percent comfortable with any potential risks before making extra contributions.

Book an appointment with a Green Associates Financial Planner and Adviser today to set up your first consultation.

At Green Associates, all of our advisers are fully licensed and listed on the ASIC Moneysmart Financial Adviser Register. Green Associates is committed to providing the best solutions for you and your wealth-creation journey.