Investors in Australia are increasingly conscious of how environmentally friendly, sustainable, and ethical their bank and superannuation accounts are. In fact, 80% of Australians expect their investments to have a positive impact on the world.

Protecting yourself from the greenwashing of ethical investments

In line with the increased demand, is the increase in the potential of companies to overrepresent just how environmentally friendly, sustainable and ethical they are; it’s important to actively protect your portfolio from greenwashing.

What is greenwashing?

Greenwashing is when a company misleads its customers on how environmentally friendly, sustainable or ethical a product, service or itself is.

Companies can do this with deceptive marketing tactics or by making false claims, without taking meaningful actions to truly meet environmental, social and corporate responsibilities. When a firm makes claims about sustainability and ‘green’ credentials or creates Corporate Social Responsibility (CSR) initiatives to distract attention from the environmental harm it causes, they’re engaging in ‘greenwashing’.

How to identify truly ethical investments

One of the main indicators used to identify ethical investments are the Environment, Social and Governance (ESG) investing standards.

The Environmental screen includes issues related to the conservation of the natural world, such as climate change and energy efficiency. The Social screen covers themes like diversity and inclusion and human rights. The Governance screen relates to standards for running a company, including executive compensation and transparent accounting.

Numerous organisations provide ESG ratings and data on companies; this is a good starting point in your research and validation of ethical investments. Examples include MSCI ESG Research, Sustainalytics and FTSE Russell.

However, investors face the struggle to know whether a company or fund really values ESG principles, or treats it as ‘table stakes’ to win money.

There are also still problems with enforcement of ESG standards as companies can “hide” these activities. For example, Woolworths (ASX:WOW) has its own ESG program and is included in most ethical managed funds. Yet, Woolworths owns 85.4% of Endeavour Group (ASX:EDV), who own Australian Leisure and Hospitality. This company owns 330 licensed venues with more than 12,000 pokie machines. To put this into perspective, Crown Casino (ASX:CWN) owns 3,500 pokie machines.

One would expect that this behaviour falls under the governance section of the ESG framework, but the monitoring and regulation of greenwashing varies greatly.

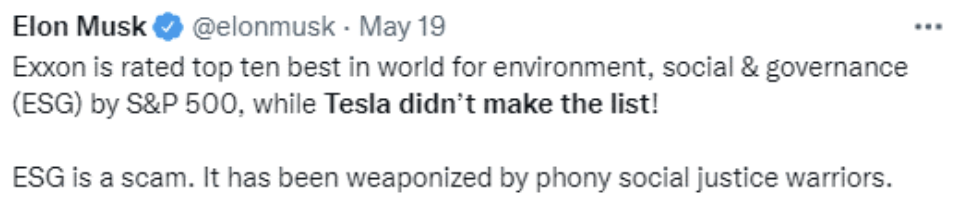

Another point in case, it would be fair to expect that a company such as Tesla – the market leader in electric vehicles and the move away from gas-guzzling combustion engines, would be the priority name for ESG investing. However, Standard & Poor’s Dow Jones removed Tesla at one point in 2022 from the S&P500 ESG index while oil companies remained untouched on the list.

Elon Musk was unsurprisingly, unimpressed, tweeting at the time:

Similarly, another example that comes to mind is Woodside Petroleum (ASX: WPL), which as of May 2022 has acquired nearly all of their carbon credits it needs for its 2030 emission reduction target. Woodside has not divested away from oil and gas and has admitted to producing 5.3 million tonnes of CO2 in their 2022 report. Woodside is able to appear as ethical and access ethical investors by greenwashing their operations with carbon credits.

The cases against Delta Airlines, Mercer Super

Fortunately, several legal frameworks do exist to protect consumers from false or misleading claims. Right now, there are chances that the US company, Delta Airlines, will be sued in a class-action lawsuit for falsely claiming that they are “the world’s first carbon-neutral airline”; this was a 10-year pledge made back in 2020 and to achieve this, Delta stated they’d improve jet efficiency, reduce fuel usage and invest in carbon removal.

A Delta passenger has alleged that the claim is greenwashing because instead of taking actions to reduce carbon emissions, Delta has been primarily purchasing carbon offsets, the benefits of which are dubious. Delta’s offsets are certified by the world’s leading certifier, Verra, and an investigation by The Guardian found that more than 90% of Verra’s rainforest offsets are actually “worthless”.

Closer to home, ASIC sued Mercer Superannuation in its first-ever greenwashing case in February 2023. ASIC alleged that while Mercer claimed its Sustainable Plus fund excluded companies involved in carbon-intensive fossil fuels, alcohol, and gambling, it actually heavily invests in 15 stocks and 34 companies across those sectors, including BHP, Heineken, and Tabcorp.

How to protect your investments from greenwashing

As ASIC is actively monitoring any sustainability-related claims made by financial institutions, it’s vital to keep updated with their investigations and findings to make sure your portfolio is truly aligned with your ethics.

Taking some personal responsibility in validating a fund’s green credentials is vital as well. Below is a list of 3 critical questions that you can use to screen your portfolio for greenwashing.

-

How clear and transparent is the fund about its ethical and sustainability investments and commitments?

The fund should openly disclose its investments and the criteria it uses to select them, and it should be easy for you to find this information in the first place, whether it’s on the website or in the Product Disclosure Statement (PDS). If you were to also request a comprehensive list of the companies your fund excludes to live up to its sustainability commitments, they should be able to supply it to you.

Analyse the language they use — are they using terms like sustainable, ethical, green, and responsible as buzzwords, or do they define what the concepts mean to them and importantly, how they are living up to them?

It is a red flag if the company or fund uses broad sweeping claims, for example, that they “avoid the fossil fuels sector”. Claims need to be more explicit and precise.

Even so, you still need to be critical about their wording; AustralianSuper’s Socially Aware investment option states that they “aim to remove the shares or fixed interest securities of companies that directly own thermal coal, oil or gas reserves” and yet there are conditions on this and some investors might also be concerned with the phrase “aim to”.

-

Can you see historical performance data that proves the fund has a solid track record of committing to sustainability and backing it up with its actions?

In addition to verifying that the fund is currently actively quantifying and reporting on its commitments, dig back even further; as they say, a glimpse into the future lies in the past.

Look for the fund’s annual reports, quarterly reports or prospectus and review data and discussions related to their sustainability efforts. Does the historical data match up with their claimed efforts to show they are taking measurable actions? Are there any legal records that show a history of greenwashing or deceptive practices?

You can even look at their previous marketing materials to screen for patterns of exaggerated or misleading statements that might indicate a history of greenwashing.

-

What certifications or third-party assessments does the investment product have to validate its ethical and responsible claims?

Finally, similar to staying on top of ASIC’s findings, there are other certifications that can help verify companies and funds that are environmentally friendly, sustainable and/or ethical.

One such certification is the B Corp certification, which verifies a company’s commitment to social and environmental performance, accountability, and transparency. Certified B Corporations are considered “leaders in the global movement for an inclusive, equitable, and regenerative economy.” What makes the B Corp certification stand out from others is that it is a holistic assessment with a rigorous certification process as well as requirements to recertify every 3 years.

We appreciate that there is a lot to review and consider when constructing and maintaining an ethical investment portfolio and it requires a certain level of technical understanding.

This is where good financial advice comes in handy. If you are unsure of how ethical your investments truly are or if you would like to reconstruct your portfolio to be ethical, book an appointment to meet with a Green Associates Financial Adviser and Planner today.

At Green Associates, all of our advisers are fully licensed and listed on the ASIC Moneysmart Financial Adviser Register. Green Associates is committed to providing the best solutions for you and your wealth-creation journey.