You have the business idea but not the capital. Here's a few tricks to have up your sleeve without outside investors.

If you’re starting out in business, there are many things that can be overwhelming, and one of the biggest areas of stress and concern is often finances. With so many things to handle, finances can easily become too overwhelming for young entrepreneurs to handle. As a knowledgeable and experienced financial adviser, Canberran and Brisbane business owners can rely on Green Associates for expert financial advice and planning services. Read on to learn a few tips that may help young entrepreneurs become more comfortable with their business finances, helping to pave the way for a successful future.

Create and Stick to a Budget

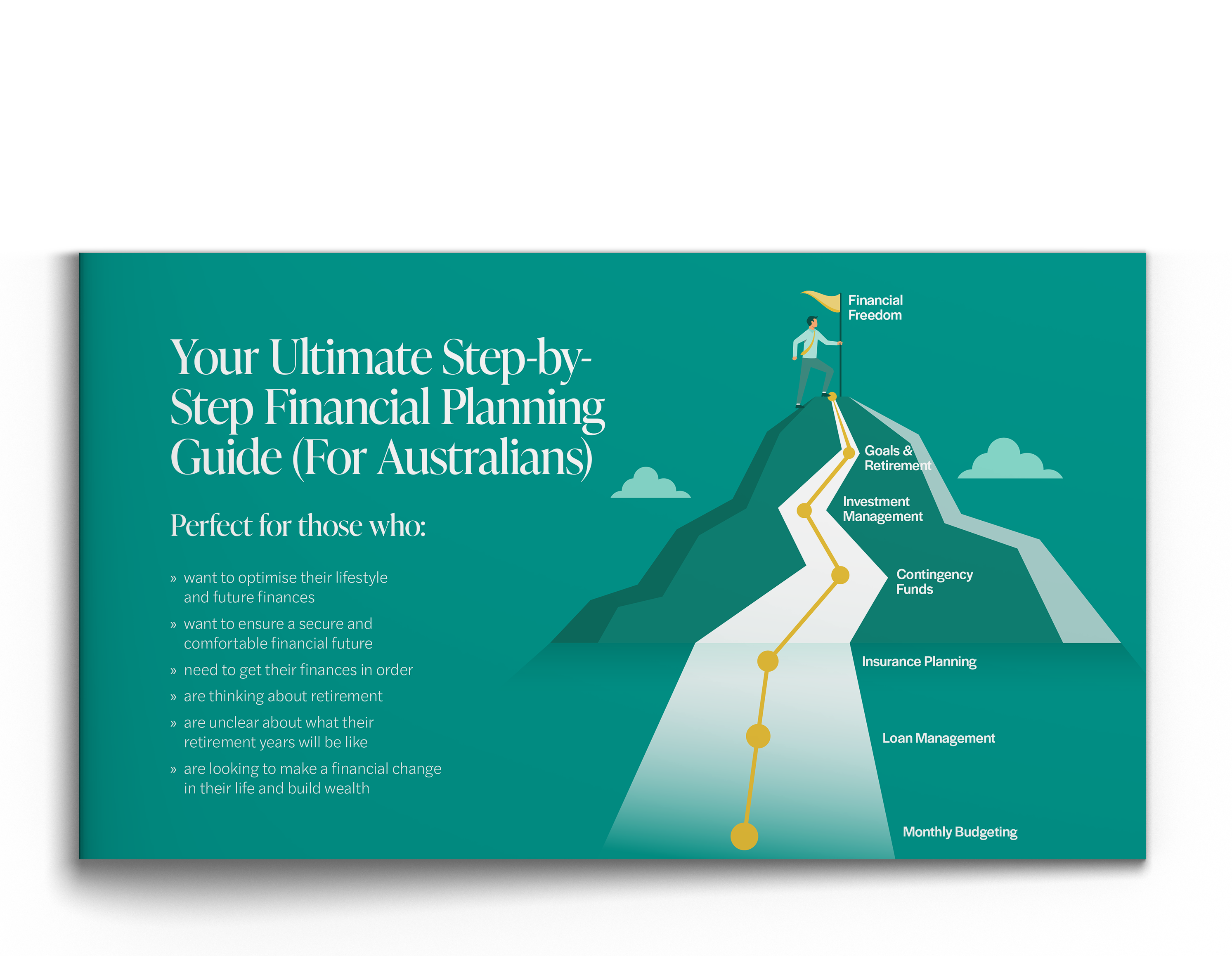

Having a budget and ensuring you stick to it is the key to preventing your small business from falling into debt. A proper budget helps to determine the needs from the wants so that you can make smart financial decisions. Many entrepreneurs fall into the trap of obtaining loans and credit cards and have no real understanding of how much they are spending. Sticking to a budget will allow you to focus on long-term investments that will help your business grow and succeed.

Have Contingency Funds

It is vital that you have some funds aside for a rainy day. Market downturns, unexpected setbacks and seasonal fluctuations may mean you need access to emergency funds. Every business goes through highs and lows and being prepared to weather the storm if and when it arrives could be the difference between success and failure.

Reinvest in Your Business

When your business begins to grow and you see your profit increase, it’s exciting and something that should be celebrated. However, it’s also important that you don’t get carried away by rapid growth and lose sight of your long-term goals. Reinvest capital back into the company, that way it will be more likely to continue to thrive. Rewarding yourself may be tempting, but it’s crucial that you reinvest by hiring more staff, increasing your marketing spend or purchasing new technology to ensure you stay ahead of the game.

Think About Your Personal Finances

Owning and running a business takes time and effort, so it’s very easy for small businesses owners to focus solely on the business and neglect their own finances. As an entrepreneur, it’s your responsibly to plan for your retirement and it’s essential that you plan and save wisely so that you can slow down later in life. Additionally, you should set aside some savings for your own personal ‘rainy day fund’ as you will need an income too in the event of a setback. For retirement planning, Brisbane and Canberra relies on Green Associates for honest, reliable, and genuine advice.

Ask for Help

Many entrepreneurs and small business owners are excellent at managing their business operations; however, many lack even basic knowledge about finances or accounting. The good news is there is help out there, so it’s important to seek out and partner with an expert in financial planning. Brisbane and Canberra business owners can trust Green Associates for all the financial guidance required for long term success. Reach out to us today to see how we can help you along your journey to wealth.

The Financial Adviser Canberra Entrepreneurs Rely On

Whether you are launching a new business or have had years of entrepreneurial success, our team is here to work beside you to ensure you have all the necessary information to make informed decision regarding the finances of your operation. Work with us today and have the peace of mind of knowing you have a financial expert to help you every step of the way. Book an appointment online or give our friendly team a call on 1300 815 921.