The Federal Government has announced changes to the legislated Stage 3 tax cuts. Read on to learn what marginal tax rates are, the changes being proposed for Stage 3, who they affect and why, and what else you should consider.

Key insights:

- Australia’s marginal tax rates increase with income, affecting all taxpayers with changes at the lowest bracket but only affecting higher earners at higher levels.

- Initially intended to benefit higher earners, the proposed changes to Stage 3 tax cuts are now aimed at offering more to low and middle earners.

- As our population ages and the tax system becomes more complex, we must look to simplify and reassess our reliance on individual wage earnings in our tax system.

What are marginal tax rates and how do they affect me?

The Australian Taxation System is a progressive system. This means that the more taxable income you generate, the higher the amount of tax you will need to pay. Your marginal tax rate is the tax rate you pay based on your highest dollar of income for that period. Since all taxpayers share the same system, any reduction in taxes in the lowest bracket benefits all taxpayers, however changes to taxes at the higher end only affect higher income earners:

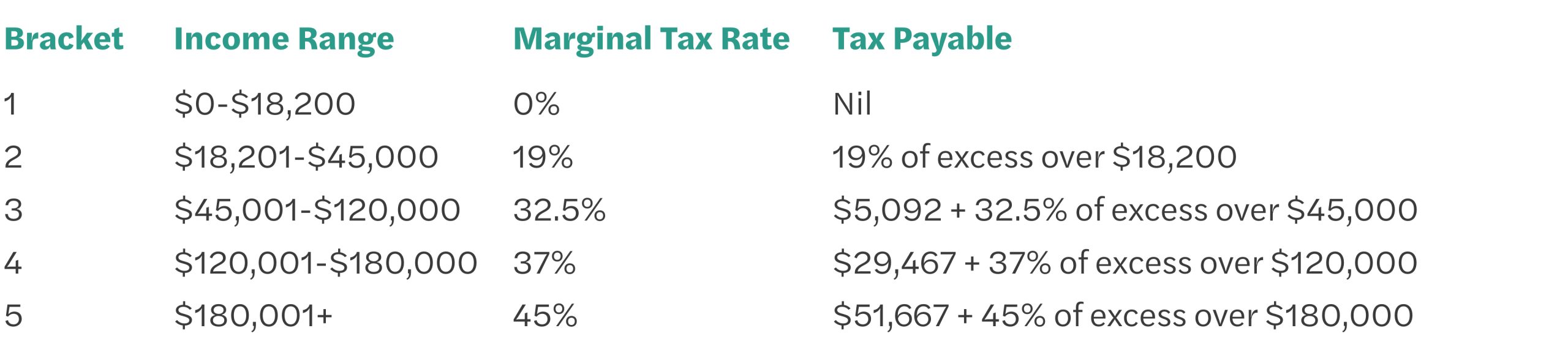

Tax table for tax year 2023-24

Source: Federal Government.

What are the Stage 3 tax cuts, and what’s changing?

In 2019 legislation was passed, supported by both the Government and Opposition of the day, to introduce changes to the marginal tax rates in three stages. Stage 1 (commenced 1 July 2019) and Stage 2 (originally legislated to commence in 2022 but brought forward to 2020 during the pandemic) were designed to help low- and middle-income earners.

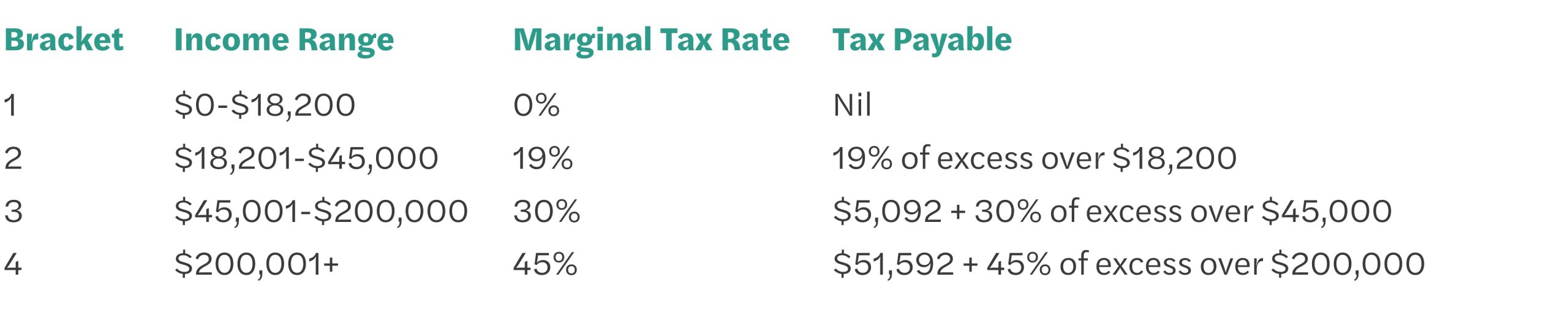

Stage 3 is due to commence 1 July 2024 and originally benefited high-income earners:

Tax table, from 1 July 2024, with legislated Stage 3 tax cuts

Source: Federal Government.

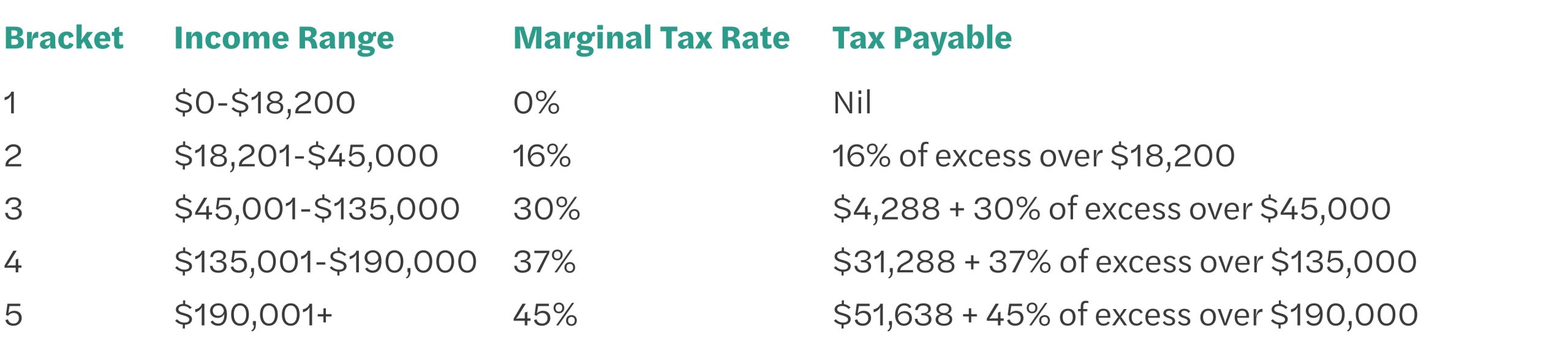

However, on 25 January 2024, the Government announced changes to Stage 3, halving the benefit for people earning over $200,000 pa, while providing increased benefits to low- and middle-income earners:

New tax table, from 1 July 2024, with proposed and revised Stage 3 tax cuts

Source: Federal Government. Updated 25 January 2024.

Why change the Stage 3 tax cuts now?

The Government has made the case that a lot has changed since they initially agreed on the three stage changes to the marginal tax rates, including a global pandemic, a cost-of-living crisis and numerous wars.

The proposed changes to Stage 3 are designed to help struggling Australians by providing additional tax relief for more Australian taxpayers.

What else do I need to consider?

Our reliance on individual wage earnings

There is a need for a much broader look at the Australian Taxation System. The current system relies far too heavily on individual wage earnings.

As our population ages over the coming decades, we will have far fewer individual taxpayers supporting the system. The aging population will also increase the demand for services such as aged care, disability support, housing and health, among others.

This relative decrease in the number of people who pay personal income taxes will put pressure on the current tax system to continue to fund these services.

The complexity of our tax system

Another growing issue being faced is the increased complexity of the Australian Taxation System. The complexity of the system adversely affects integrity and reduces transparency. It also imposes unnecessary compliance costs on taxpayers and other costs on the Australian economy, totalling approximately $40 billion annually.

However, in order to simplify the tax system changes to tax design and governance are required, making it difficult to address without broad community support.

Next steps

It’s important for you to understand how the proposed Stage 3 changes may affect you. We encourage you to carefully review the tables above based on your current income, and if you still have any questions, please consult with your Green Associates financial adviser or learn more about our tax advice and planning services.