Our Take On The 2024-25 Federal Budget

Our overall observation of the budget is that there were no surprises of note and no major changes to the overall structure of the tax system. We were happy to see no changes to the superannuation system in this budget as the system needs confidence to be effective and constantly changing the rules impacts the willingness for people to save for their retirement.

One topic which appears to have brought about a level of controversy is the $300 rebate for energy bills. There are two parts to this controversy. The first is the possible impact on inflation, and therefore interest rates. The second is the perceived fairness of a subsidy which every household will benefit from, regardless of their income.

We believe it’s incorrect to then assume that “giving” people $300 will increase inflation in other areas.

On the inflation front, the Treasurer was correct in explaining this will help reduce inflation. Inflation is based on rising costs. The rebate will reduce the cost of energy and therefore its impact on inflation. We believe it’s incorrect to then assume that “giving” people $300 will increase inflation in other areas. This is because there should be no financial behaviour change for most. A large proportion of lower income households pay their energy bills in regular instalments, so the saving will be minimal. If you pay fortnightly, an $11 reduction in your payment isn’t going to lead to a change in consumer spending behaviour. For those who pay quarterly, the reduction due to a $75 credit is also unlikely to mean a change in behaviour, because there’s been no increase to income.

On the inflation front, the Treasurer was correct in explaining this will help reduce inflation. Inflation is based on rising costs. The rebate will reduce the cost of energy and therefore its impact on inflation. We believe it’s incorrect to then assume that “giving” people $300 will increase inflation in other areas. This is because there should be no financial behaviour change for most. A large proportion of lower income households pay their energy bills in regular instalments, so the saving will be minimal. If you pay fortnightly, an $11 reduction in your payment isn’t going to lead to a change in consumer spending behaviour. For those who pay quarterly, the reduction due to a $75 credit is also unlikely to mean a change in behaviour, because there’s been no increase to income.

For the notion of fairness for the payment, it’s important to take a holistic approach to the scheme. Last year’s energy rebate applied only to pension and concession holders. This time the government wanted to assist middle- income households, who are the most affected by the increase in interest rates. Once the rebate was to be applied beyond concession card holders, the cost and complexity to implement the scheme to limit high income households would be larger than the payment of the benefits, thereby removing any benefit to the budget. It’s also worth noting that over 95% of Australian’s earn income below the top marginal rate, so the percentage of those who the government would want to remove from the scheme is just 5%.

It was good to see some improvement in the rental assistance payment. The government has improved JobSeeker payments, but more work needs to be done in this area. Also great to see superannuation will be paid on Paid Parental Leave payments, another long overdue change which won’t add to inflation but will improve the retirement of parents eligible for the payment.

Importantly, anyone who has since repaid their loan in full will still receive the tax credit.

The change to the HELP/HECS system, introducing an alternate increase to the rate of indexation, being the lower of CPI

or average wages increases, was excellent. Also demonstrates the positive impact the independent politicians can have, as they

were driving this change. The best part is the retrospective change, meaning the 7.1% increase those with debts received last year, will revert back to 4.7%. Importantly, anyone who has since repaid their loan in full will still receive the tax credit.

The change to the HELP/HECS system, introducing an alternate increase to the rate of indexation, being the lower of CPI

or average wages increases, was excellent. Also demonstrates the positive impact the independent politicians can have, as they

were driving this change. The best part is the retrospective change, meaning the 7.1% increase those with debts received last year, will revert back to 4.7%. Importantly, anyone who has since repaid their loan in full will still receive the tax credit.

Finally, the commitment to increased funding for aged care and Home Care services was good to see as demand for these services will only grow at rates much higher than the past due to our aging population.

This was a pretty boring budget, but one which shouldn’t impact the RBA’s job to bring down inflation and therefore shouldn’t be the reason for changes in interest rates.

Superannuation

Paying superannuation on Paid Parental Leave.

Proposed effective date: 1 July 2025

The Government will pay superannuation on the Paid Parental Leave scheme at 12% of the PPL rate, which is set at the national minimum wage (currently $882.75 per week). The contribution rate will be the same as the new super guarantee rate come 1 July 2025.

The proposal will help to normalise parental leave as a workplace entitlement, close the super gender gap and reduce the impact of taking parental leave on retirement incomes.

It builds on legislation yet to be passed to gradually increase PPL to 26 weeks by July 2026.

Contributions will be taxed at the super tax rate of 15% and count towards the concessional contributions cap.

The Australian Tax Office (ATO) will make the payments directly to the recipients super account.

Relieving cost of living pressure

Energy bill relief is on the way

Proposed effective date: 1 July 2024

All households will receive a $300 a year rebate in quarterly instalments on their energy bills. Eligible small businesses will receive $325 a year.

Making it easier for students to manage and repay their loans

Proposed effective date: 1 June 2023 (backdated)

The Government will cap the indexation rate for student loans at the lower of either the Consumer Price Index (CPI) or the Wage Price Index (WPI).

This will apply to all Higher Education Loan Program (HELP), vocational education and training (VET) Student Loans, Australian Apprenticeship Support Loans and other student loan accounts.

This proposal is designed to prevent growth in student debts from outpacing wages in the future.

It means the indexation rate will be reduced from 7.1% to 3.2% in 2023 and from 4.7% to around 4% in 2024.

The ATO will automatically apply an indexation credit to reduce the outstanding loan.

You can estimate the amount of credit you’ll receive here.

Social security and aged care

Relieving cost of living pressures for retirees

1 July 2024

The Government will extend the existing two- year freeze on deeming rates by another 12 months.

The lower rate of 0.25% and upper rate of 2.25% will remain frozen until 30 June 2025.

The deeming rate is the assumed return that retirees receive on their investments and helps to work out their age pension entitlements.

The freezing of deeming rates has provided some certainty in an environment of rising interest rates to help alleviate cost of

living pressures for retirees. It’s part of the government’s broader efforts to support individuals on fixed incomes during times of economic fluctuation.

Increasing Rent Assistance

Proposed effective date: 20 September 2024

The Government will increase the maximum Rent Assistance rate by 10% to help address rental affordability challenges.

This is in addition to the 15% increase in September 2023.

Proposed effective date: 20 September 2024

The Government will increase the maximum Rent Assistance rate by 10% to help address rental affordability challenges.

This is in addition to the 15% increase in September 2023.

Securing cheaper medicines

Proposed effective date: 1 January 2025

There will be a temporary freeze on indexing the Pharmaceutical Benefits Scheme (PBS) co- payment.

In 2024, the co-payments are $31.60 for general patients and $7.70 for concessional patients.

From 1 January 2025, the Government will introduce:

- a 1-year freeze on indexation for PBS co- payments for general patients

- up to a 5-year freeze for concessional patients. The $1 discount will gradually be removed without leaving patients worse off.

Proposed effective date: 1 January 2025

There will be a temporary freeze on indexing the Pharmaceutical Benefits Scheme (PBS) co- payment.

In 2024, the co-payments are $31.60 for general patients and $7.70 for concessional patients.

From 1 January 2025, the Government will introduce:

- a 1-year freeze on indexation for PBS co- payments for general patients

- up to a 5-year freeze for concessional patients. The $1 discount will gradually be removed without leaving patients worse off.

Increasing JobSeeker payments for recipients with a partial capacity to work

Proposed effective date: 20 September 2024

The Government is extending eligibility for the higher rate of JobSeeker Payment to single recipients who can only work up to 14 hours per week. The higher rate is currently $816.90 per fortnight.

Eligible recipients will receive an increase of at least $54.90 per fortnight, including the Energy Supplement.

This will provide extra support to people with limited or no capacity to work due to physical, intellectual or psychiatric impairment (but don’t qualify for Disability Support Pension).

Increasing the flexibility for carers to work and study

Proposed effective date: 20 March 2025

The Government will provide greater flexibility for Carer Payment recipients to structure their work and study commitments around their caring role.

- Recipients will be able to work up to 100 hours over a four-week period.

- Travel time, education and volunteering won’t be counted.

- A six-month suspension period will be introduced for recipients who work over the limit. So if their circumstances change, they won’t need to reapply.

- Temporary Cessation of Care days can be used for one-off instances of exceeding the limit.

This will help carers to better balance work, study, volunteering and their caring duties, particularly if they live in regional and remote areas and need to travel further.

Providing extra funding for aged care

Proposed effective date: From 2023-24

The Government will provide $2.2 billion over five years from 2023–24 to deliver key aged care reforms.

The Government is also providing an extra 24,100 Home Care packages in 2024–25 to reduce wait times.

Tax – personal

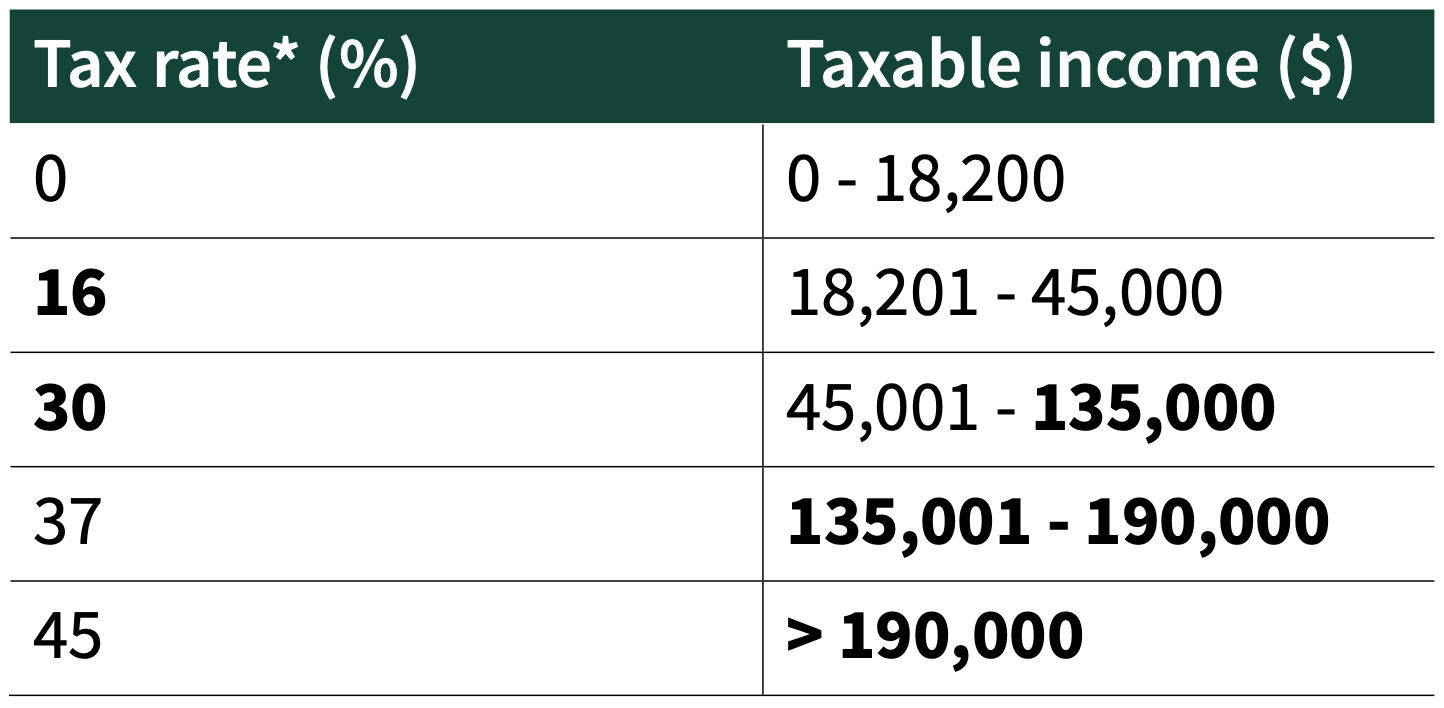

No changes to previously legislated tax rates

Effective date: 1 July 2024

In 2024-25, the effective tax-free thresholds will increase.

- Individuals below age pension age – $22,575

- Individuals of age pension age, eligible for Seniors and Pensioners Tax Offset (SAPTO):

- Single – $35,813

- Member of a couple (each) – $31,888*

- Illness separated couple (each) $34,626*

*Some Medicare levy may be payable.

These thresholds include the $700 Low Income Tax Offset (LITO).

Increasing the Medicare Levy low-income thresholds

Proposed effective date: 1 July 2023

Low-income taxpayers will continue to pay a reduced rate or be exempt from the Medicare levy. The threshold for:

- Singles will increase from $24,276 to $26,000,

- Families will increase from $40,939 to $43,846,

- Single seniors and pensioners will increase from $38,365 to $41,089

- Families (seniors and pensioners) will increase from $53,406 to $57,198.

For each dependent child or student, the family income thresholds increase by a further $4,027.

Proposed effective date: 1 July 2023

Low-income taxpayers will continue to pay a reduced rate or be exempt from the Medicare levy. The threshold for:

- Singles will increase from $24,276 to $26,000,

- Families will increase from $40,939 to $43,846,

- Single seniors and pensioners will increase from $38,365 to $41,089

- Families (seniors and pensioners) will increase from $53,406 to $57,198.

For each dependent child or student, the family income thresholds increase by a further $4,027.

Tax – Small Business

Extending the $20,000 instant asset write-off

Proposed effective date: 1 July 2024

The Government will extend the instant asset write-off scheme by 12 months until 30 June 2025 to support small businesses with improving cashflow and encourage business investment.

Small businesses, with annual turnovers of less than $10 million, will be able to immediately deduct the full cost of eligible assets costing less than $20,000.

Keeping women safe

Proposed effective date: 1 July 2023

The Government has pledged $925.2 million over five years to the Leaving Violence Program to support victim survivors leaving a violent intimate partner relationship.

From 1 July 2025, victims of domestic violence will be able to access up to $5,000 a year of financial support indexed to keep pace with inflation.

The Government has also allocated $1 billion to crisis housing for women and children escaping domestic violence.